AvaTrade Review

Overview

AvaTrade is a leading international forex broker, and are part of the AVA Group of companies. Being founded in 2006, AvaTrade is one of the oldest online brokerages. Our review details the trading platforms, mobile app, deposit methods, and MT4 integration. We also compare trading costs, spreads and leverage. From Bitcoin to vanilla options, whatever you want to trade, see if Avatrade will suit you.

The company now has four offices around the world, located in Japan, Australia, Ireland, and the British Virgin Islands. As one of the largest and most respected online brokerages in the world, AvaTrade accepts clients from a huge range of regions, and accepts trading accounts in a variety of currencies.

The firm also recently announced a major partnership with English Premier League Champions Manchester City, underlining the brands growth and visibility.

Regulation & Reputation

Choosing a forex broker that is regulated by a reputable regulatory agency is of the utmost importance, for regulated status helps to ensure a company’s trustworthiness and competence. AvaTrade is most definitely a reputable firm, being regulated by several authorities from around the world.

- In Europe, the broker is regulated by the Central Bank of Ireland under license #C53877.

- In Australia, the broker is licensed by the ASIC under license #406684.

- In Japan, the broker is licensed by the FSA under license #1662 and the FFA under license #1574.

- In South Africa, the broker is licensed by the FSCA under license #45984.

- In the middle east, the broker is licensed by the Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) under license #190018.

- In Israel, the broker is licensed by the Israel Securities Authority under license #514666577.

AvaTrade is among the best online brokerages in the industry in terms of reputation and reliability, and you can trade with confidence. The company has won numerous awards for “Best Customer Support”, “Best Alert System”, “Best Financial Derivative Trading Provider”, and “Best Forex Broker YEAR”

The firm have also now opened up the market in Canada via a collaboration with Friedberg Direct. Friedberg Direct is a division of Friedberg Mercantile Group Ltd., a member of the Investment Industry Regulatory Organization of Canada (IIROC), the Canadian Investor Protection Fund (CIPF), and most Canadian Exchanges. Friedberg Mercantile Group Ltd. is headquartered at 181 Bay St., Suite 250, Toronto, ON M5J 2T3, Canada.

Types of Trading Platforms Available

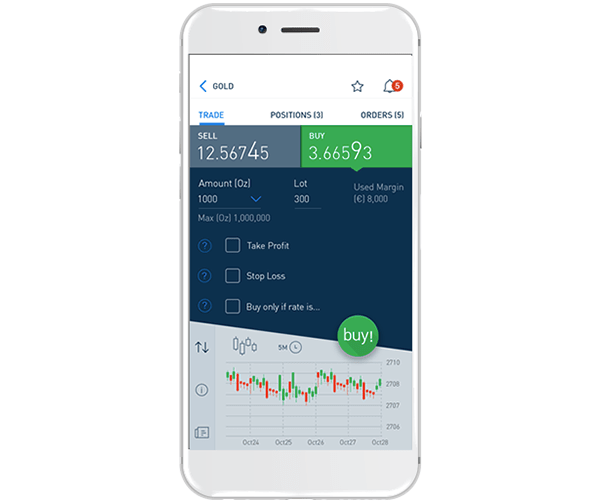

One of the most impressive aspects of AvaTrade is the number of trading platforms available to traders. There is literally something for everyone here, whether you’re a beginner, seasoned trading veteran, or something else. The following platforms offered by AvaTrade are:

- MetaTrader 4 platform

- MetaTrader 5 platform

- Meta Trader for Mac

- Meta Trader for mobile trading (Download the Avatrade app directly here)

- Meta Trader for web trading

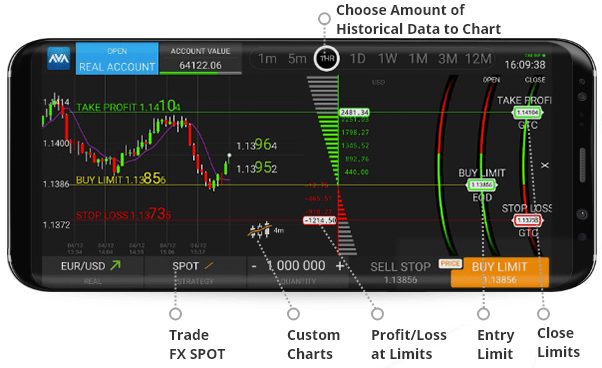

- The AvaTradeAct platform (Proprietary Platform)

In addition to these platforms, AvaTrade features various automated trading softwares to suit every person’s needs. The following are:

- MQL5 Signal Service

- API Trading

- Duplitrade

Trading Accounts Offered

AvaTrade keeps things simple with their accounts by offering only two account types to most traders. A standard account and a demo account. Standard accounts can be opened with as little as $100 using credit cards or with $500 via wire transfer.

In addition to the two standard accounts, Muslim traders are accommodated by offering ‘swap free accounts’ that operate in accordance to the Islamic Sharia Principle of interest free trading.

As well, professional traders can open up MAM accounts to easily manage several accounts for their clients. These types of accounts include the following features:

- Ability to create multiple sub trading groups

- All MT4 order types such as stops, limits and close are available

- Expert Advisors (EAs) compatible

- Minimum lot at 0.01 lots

- Multiple allocation parameters

- Order placements for unlimited client accounts

- Trade order placements from a master account

AvaTrade also offers negative balance protection. This ensures that clients cannot lose more than their account balance. Should the market move against the client to the extent that the trader is put in a negative balance position, the brokerage will automatically refund the difference through a ‘negative balance adjustment’.

Bonuses & Promos

Bonuses may be available dependent upon geographical location; please contact AvaTrade for more information.

Instruments & Assets

AvaTrade excels once again at offering traders a wide array of financial trading instruments. Investors are free to trade:

- Forex – Over 50 currency pairs available, including all majors, minors, and many exotics available 24 hrs a day, 7 days a week. Traders can enjoy competitive spreads as low as 0.8 pips, and leverage up to 400:1.

- Cryptocurrency – (Not available in Canada or UK) – Traders can trade 9 different cryptocurrencies with up to 20:1 leverage. These now include Ripple, Ethereum, Bitcoin and Bitcoin cash.

- Indices, Bonds, Stocks, ETFs & Commodities – Traders of AvaTrade enjoy the highest of leverage along with very competitive and low spreads for trading these financial assets.

- Options – Avatrade have made trading options accessible for traders of all experience levels. The new options trading platform reduces the complexity of vanilla options and opens up a range of opportunities for those curious about using the product.

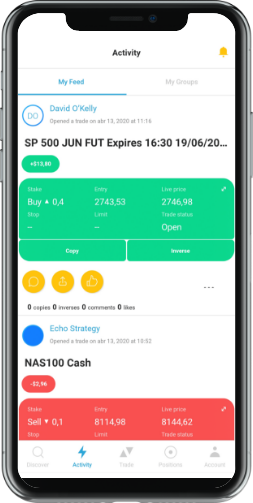

AvaSocial

AvaTrade clients can also download the broker’s social and copy trading platform – AvaSocial. Available on iOS and Android devices, the mobile app lets clients replicate the trades of successful investors.

Users can opt to manually trade on market signals or to follow a fully automated service. 24/7 trading is available on forex, stock, crypto and commodities markets.

AvaSocial is also an excellent social trading platform. Users can interact with other traders via community channels and ask questions on specific strategies, find out more about crypto markets, or seek out a trading mentor. This makes it a great tool for beginners.

Customer Support

AvaTrade offers excellent customer support via several multilingual options. The options include live chat, email, FAQ page, social media, fax and through telephone.

Telephone support is offered in a number of languages and countries throughout the world, including 21 different countries throughout Europe, 2 countries in Africa, 6 countries across Asia, 4 countries across South America, 2 countries in the Middle East and Australia.

The support offered is prompt and informative from local customer support representatives. The recent partnership in Canada for example, gives customers access to customer services of locally based Friedberg Direct.

Deposit & Withdrawal

Deposits – AvaTrade offers their clients a variety of deposit options. Traders may fund their accounts with credit cards (VISA, MasterCard, debit), Bank Wire Transfers, and numerous forms of E-Wallets such as Paypal, Skrill, NETELLER and WebMoney.

The minimum initial deposit for opening up an account is only $100.

Withdrawals – Traders can withdraw their funds via the same methods used for deposits. Withdrawal requests will take up to 5 business days to process.

Once processed, withdrawals will be completed as soon as the methods allow them to be completed. The fastest method of withdrawal is by using the Ava Debit Mastercard, which traders can apply for once signed up for an account.

AvaTrade Day Trading Tools

- Education – AvaTrade has an exceptional education center. It may be the best one we’ve ever seen, complete with videos, eBooks, tutorials, glossaries, and more. There is a whole section on their website dedicated to educating their traders. As well, the whole site in general is very informative for day traders.

- Trading Tools – AvaTrade has an abundance of features dedicated to successful day traders. One of their most impressive features is their automated trading software bundles which is exceptional for day trading.

- Range of assets – There is a massive array of assets to choose from, which makes this brokerage great for day traders who are just beginning or seasoned veterans.

- Free Trading Coaching Course – The recent promotion of the partnership with Manchester City Football Club included some free trading courses. Specific details can be found here: MCFC Online trading course.

AvaTrade has also introduced a couple of particularly useful new trading tools and services…

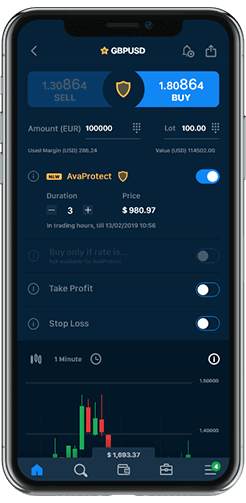

AvaProtect

The firm’s exclusive AvaProtect tool enables clients to get their money back on losing trades. The user-friendly risk management tool lets investors protect a trade against losses up to $1 million over a set period. Clients simply need to a pay a small hedging fee.

AvaProtect is available on the broker’s proprietary trading platforms and can be activated in a few straightforward steps. Traders simply need to select the instrument, click the AvaProtect icon, choose the length of protection, and confirm the fee and expiry trade.

Trading Central

AvaTrade has partnered with Trading Central to provide powerful technical analysis tools and market insights. Clients can make informed investment decisions based on trading plans developed by veteran analysts at Trading Central.

Also available through the platform is a daily strategy newsletter, intuitive pattern recognition technology, plus a host of advanced indicators on 115 forex charts. Trading Central also tracks 7000 media sources for investors interested in fundamental analysis.

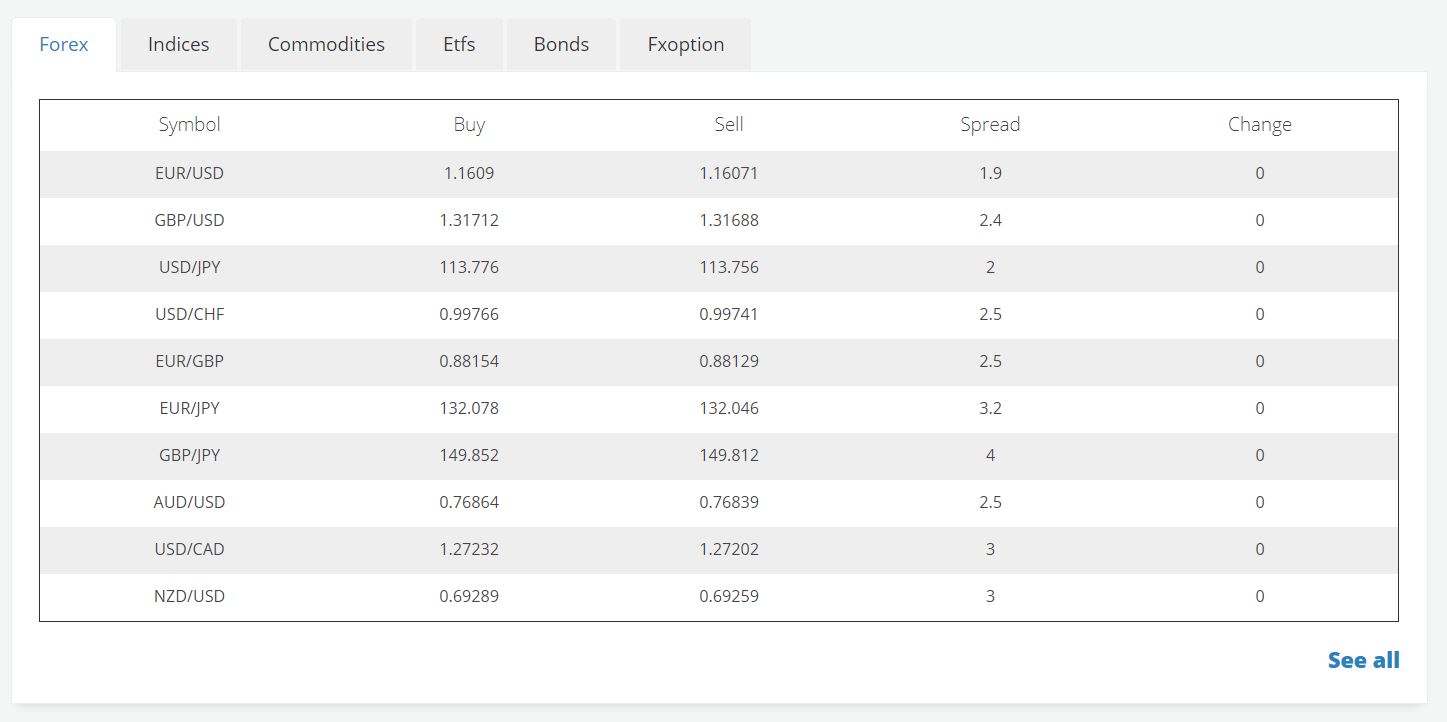

AvaTrade Spreads

Examples of the variable spreads at AvaTrade;

Spreads are competitive at Avatrade, and they are constantly working to reduce them further. Particularly in the crypto market, the firm have made huge strides.

Just recently spreads on cryptocurrency trades were slashed by 50% – but an announcement has revealed they have been trimmed by another third. As brokers gain confidence in the liquidity of the markets, they can be braver with spreads.

Accepted Countries

AvaTrade accepts traders from Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use AvaTrade from United States, Belgium, Zimbabwe, Iran, Iraq, India, Pakistan, Spain, Russian Federation.

Alternatives to AvaTrade

If you are looking for alternatives to AvaTrade we have compiled a list of the top 5 brokers that are similar to AvaTrade below. This list of brokers like AvaTrade is in order of similarity and only includes companies that accept traders from your location.

- Pepperstone – Pepperstone offers CFD trading to both retail and professional traders. Clients can trade FX, indices, commodities and shares on MT4, MT5 and cTrader platforms.

- Skilling – Skilling are an exciting brand, regulated in Europe and beyond, offering 900+ instruments across 7 asset classes and spreads from 0.2 pips.

- TMGM – TMGM is a competitive forex and CFD broker with a wide range of instruments, features and tools provided at low-cost.

- FBS – FBS is a top online broker offering MT4 & MT5 trading across a range of popular markets. Multiple account tiers and loyalty bonuses are available.

- Axi – Axi is a global online FX and CFD trading company, trusted by investors around the world. Highly leveraged trading opportunities plus a $0 minimum deposit make it popular with beginners and seasoned traders.

FAQ

Is Avatrade legitimate?

Yes. Avatrade are legitimate forex and CFD brokers. The brand is regulated around the world, including in Europe, Australia and South Africa.

Are Avatrade Regulated?

Yes, the brand is regulated around the world:

- AVA Trade EU Ltd is regulated by the Central Bank of Ireland.

- Ava Capital Markets Australia Pty Ltd is regulated by the ASIC.

- Ava Capital Markets Pty is regulated by the South African Financial Sector Conduct Authority (FSCA ).

- Ava Trade Japan K.K. is regulated in Japan by the FSA (No.1662) and the FFAJ (No.1574).

Avatrade are also regulated in Abu Dhabi

What is the minimum deposit for Avatrade?

An Avatrade account can be opened with $100 (or £100 or €100).

Is Avatrade a market maker?

No. Avatrade are a broker, not market makers.

How long does it take to withdraw from Avatrade?

Avatrade process withdrawals within 1 day. Different withdrawal methods can sometimes take longer for funds to actually clear however.

Credit/Debit Cards – up to 5 business days

E-wallets – 24 hours

Wire Bank Transfers – up to 10 business days

Wire transfer delays often depend on the Country and bank in question.

What is Avatrade leverage?

Leverage at Avatrade will vary by asset, and the Country of origin of the trader.

In the EU and UK, leverage is capped at 1:30 due to European regulated.

The non-EU limit is 1:400

Higher leverage may be possible with a professional account if traders are based in Europe.

What methods can I use to deposit funds at AvaTrade?

Deposits can be made through credit cards (VISA, MasterCard, debit), Bank Wire Transfers, and numerous forms of E-Wallets such as Paypal, Skrill, NETELLER and WebMoney.