Comprehensive XM Broker Review 2024

Overview

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Australian Securities and Investments Commission (ASIC) – Australia

- International Financial Services Commission (IFSC) – Belize

- Dubai Financial Services Authority (DFSA) – UAE

- Financial Conduct Authority (FCA) – UK

- Top-tier Regulation: High client fund protection and security.

- Low Minimum Deposit: Starting at just $5, making it accessible for beginners.

- No Hidden Fees: Transparent pricing with no commissions on most accounts.

- Wide Range of Instruments: Over 1,000 financial instruments available.

- High Deposit for Shares Account: Minimum of $10,000 may deter smaller traders.

- Limited Crypto Offerings: Fewer cryptocurrency pairs compared to specialized brokers.

- Bonus Availability: Regional restrictions limit access to promotions.

Introduction to XM

XM is a globally renowned broker offering a wide range of trading services, particularly in forex and CFD trading. Established in 2009, XM has gained an impressive reputation, serving over 5 million clients across more than 190 countries. Known for its emphasis on transparency, superior customer service, and user-friendly trading platforms, XM provides access to over 1,000 financial instruments. Whether you are a beginner or an experienced trader, XM offers the tools and services needed to enhance your trading experience.

Key Features of XM

Regulated by Multiple Authorities: XM is governed by respected regulatory bodies such as CySEC, ASIC, DFSA, FCA, and IFSC, ensuring a high level of security for traders.

Wide Range of Trading Instruments: Clients can trade in forex, commodities, indices, stocks, and cryptocurrencies, providing diverse investment opportunities.

Flexible Leverage: Up to 1:888, depending on the account type and regulatory jurisdiction.

Tight Spreads: XM offers competitive spreads, starting from as low as 0.6 pips.

No Requotes: XM guarantees no requotes, enabling smooth trade execution in volatile markets.

Regulatory Compliance

XM is a well-regulated broker, offering a safe and secure trading environment. It operates under the strict oversight of several globally recognized regulatory bodies:

| Regulatory Authority | Country | License Number |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | 120/10 |

| Australian Securities and Investments Commission (ASIC) | Australia | 443670 |

| International Financial Services Commission (IFSC) | Belize | IFSC/60/354/TS/19 |

| Dubai Financial Services Authority (DFSA) | UAE | F003484 |

| Financial Conduct Authority (FCA) | UK | 705428 |

These licenses ensure that XM adheres to international financial standards, including client fund segregation and negative balance protection, providing a high level of security for its clients.

Account Types at XM

XM offers several account types, catering to different trading styles and preferences:

| Account Type | Minimum Deposit | Leverage | Spreads | Commission | Best For |

|---|---|---|---|---|---|

| Micro Account | $5 | Up to 1:888 | From 1 pip | None | Beginners and small-scale traders |

| Standard Account | $5 | Up to 1:888 | From 1 pip | None | Intermediate traders |

| XM Ultra-Low Account | $50 | Up to 1:888 | From 0.6 pips | None | Low-cost trading |

| Shares Account | $10,000 | 1:1 | Variable | None | Stock CFD traders |

- Micro Account: Best for beginners, with a lot size of 1,000 units, allowing for small trades.

- Standard Account: Similar to the Micro Account but with standard lot sizes, suitable for intermediate traders.

- XM Ultra-Low Account: Ideal for traders seeking tight spreads, with spreads starting from 0.6 pips and no commission.

- Shares Account: Designed for traders who want to trade stocks without leverage.

Demo Account: XM also offers a free demo account, where traders can practice and develop strategies with virtual funds before committing to real-money trading.

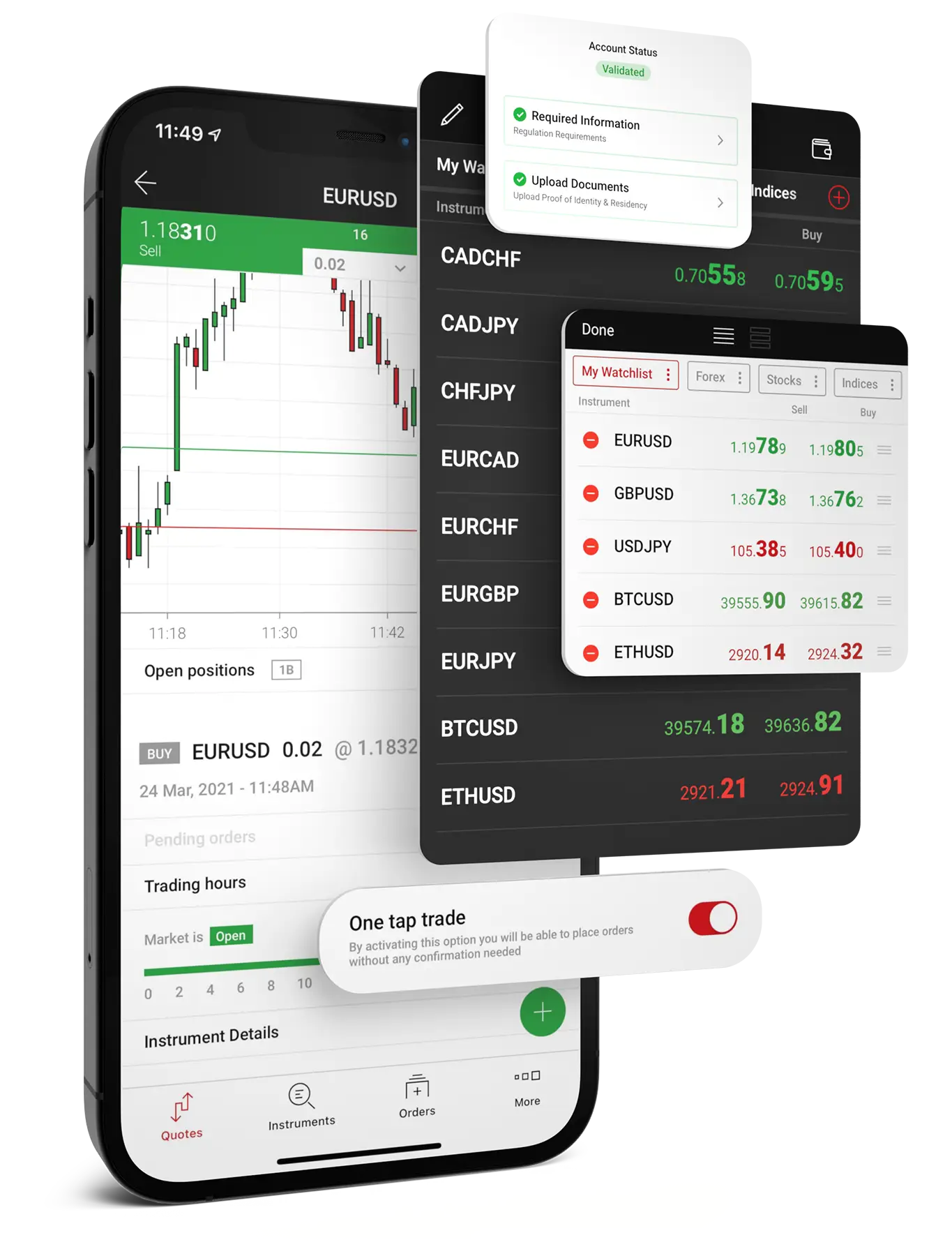

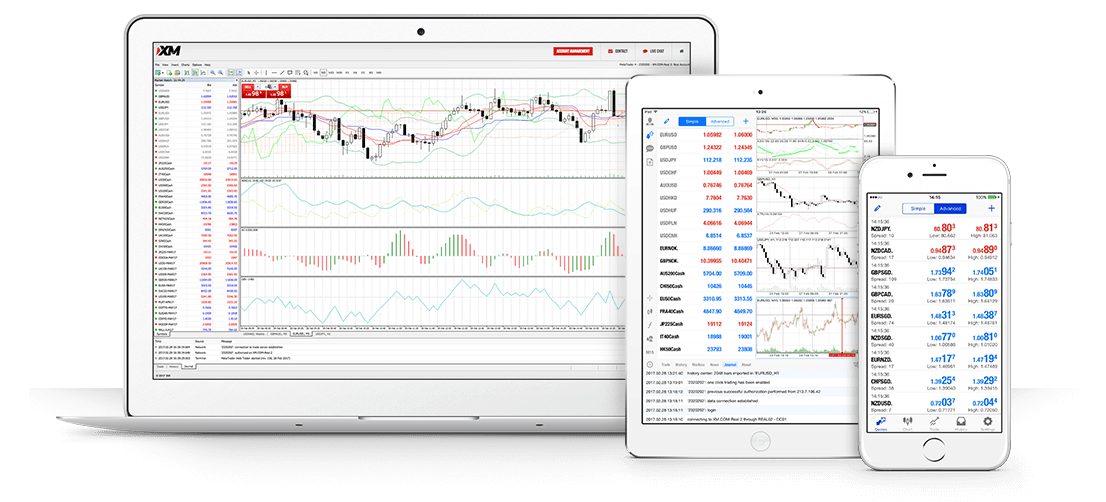

Trading Platforms

XM offers multiple trading platforms to suit various trading needs, all accessible across devices:

- MetaTrader 4 (MT4): The classic trading platform, known for its simple interface, advanced charting tools, and support for Expert Advisors (EAs) for automated trading.

- MetaTrader 5 (MT5): An upgraded version of MT4, offering more timeframes, advanced charting features, and access to more instruments, including stocks and commodities.

- XM WebTrader: A browser-based version of MT4/MT5, accessible from any device without needing to download software.

- Mobile Trading: XM provides trading apps for both iOS and Android, allowing traders to manage their portfolios and execute trades from anywhere.

Spreads and Commissions

XM is known for offering competitive spreads and low trading costs, with spreads starting from 0.6 pips for major currency pairs like EUR/USD. Most accounts are commission-free, with the cost built into the spreads. The broker's transparency in fee structures ensures there are no hidden charges or unexpected fees.

Deposit and Withdrawal Options

XM offers a wide variety of deposit and withdrawal methods, ensuring flexibility and convenience for traders across the globe. Some popular options include:

- Credit/Debit Cards: Visa, MasterCard

- Bank Transfers

- E-wallets: Neteller, Skrill, PayPal

Deposit and Withdrawal Fees: XM does not charge fees for deposits or withdrawals, although traders should be aware of potential fees from their payment providers.

Customer Support and Educational Resources

XM is well-known for its 24/5 customer support, available in multiple languages via live chat, phone, and email. The broker also offers personalized account managers to help clients with any queries or trading needs.

Educational Resources:

- Live Webinars: XM hosts regular webinars in different languages, covering trading strategies, risk management, and market analysis.

- Video Tutorials: XM offers tutorials that explain how to use trading platforms, understand market analysis, and refine trading strategies.

- Market Analysis: Daily updates on market trends, technical analysis, and economic news, helping traders stay informed about market movements.

Bonuses and Promotions

XM frequently runs bonuses and promotions, although availability depends on the trader's jurisdiction. Some common promotions include:

- Deposit Bonuses: XM offers bonuses on initial deposits, allowing traders to increase their available funds for trading.

- Loyalty Programs: XM's loyalty program rewards traders with points that can be redeemed for trading credits.

Awards and Recognition

XM has received several awards for its services, highlighting its commitment to excellence:

- Best Forex Execution Broker 2021: Recognized for fast and accurate trade execution.

- Global Forex Broker of the Year 2020: Acknowledged for its wide-reaching services and client satisfaction.

- Best Trading Platform 2019: XM was awarded for its robust trading platforms, providing a seamless trading experience for users.

- Best Forex Broker for Europe 2020: This award recognizes XM's outstanding performance in the European market.

Pros and Cons of XM

Pros:

- Regulated by Top-Tier Authorities: XM operates under respected regulators, ensuring client safety and fund protection.

- Low Minimum Deposit: Traders can start with as little as $5, making it accessible for beginners.

- Wide Range of Instruments: Over 1,000 financial instruments, providing traders with diverse trading opportunities.

- Tight Spreads and No Commissions: XM offers competitive spreads, with no commission on most accounts.

- Extensive Educational Resources: Traders have access to webinars, tutorials, and market research to enhance their trading skills.

Cons:

- High Minimum Deposit for Shares Account: The $10,000 minimum deposit for stock trading may be prohibitive for some traders.

- Limited Cryptocurrency Options: While XM offers cryptocurrency trading, its selection is limited compared to other brokers.

- Regional Restrictions on Bonuses: Due to regulatory restrictions, XM's promotions and bonuses may not be available to traders in certain regions.

Conclusion

XM is a trusted and versatile broker, offering a variety of account types, tight spreads, and an extensive range of trading instruments. Whether you are a beginner or an experienced trader, XM provides the tools, platforms, and educational resources to support your trading journey. With strong regulatory backing and a client-centric approach, XM is an excellent choice for anyone looking for a secure and well-rounded trading experience.