Picking a Low Spread Forex Broker or Zero Spread Account is essential, especially for Forex trading and scalping. Paying less cuts trading costs in the long run, especially if you are an active trader. We’ve put together this list of the best zero brokers to make things easier for you. We collected trustworthy and regulated brokers that have a strong reputation.

Low Spread Forex Brokers 2022

Based on our research, here are the best low spread brokers or zero spread brokers.

- Pepperstone – Lowest Spread Forex Broker Overall

- FP Markets – Ultra-competitive Low Spreads Broker

- AvaTrade – Fixed Low Spreads Forex Broker

- IC Markets – Raw Spreads Account Forex Broker from 0.0 Pips

- Forex.com – Best Execution Low Spread Forex Broker

- FXTM – High Leverage Tight Spreads Broker

- eToro – Great Copy Trading Low Spread Forex Broker

- IG – No Commission Broker with Low Spreads

- FxPro – 0 Spread Forex Broker

- Fusion Markets – Low Commission Forex Broker

1. Our Top Pick

What are Low Spread or Zero Spread Brokers?

The Lowest Spread brokers offer the lowest Forex Spreads or zero spreads. Trading costs declined over recent years as forex brokers compete to win more clients. Many offer zero spreads as an extra enticement, but it is essential to know the terms and conditions before choosing a broker. Our guide covers everything you need to know, so read on. Read more on spreads.

The Lowest Spread for the EURUSD pair ranges from 0.1 – 0.9 pips with no commission charge. However, you should check all fees, including overnight, commissions, non-trading, deposit or withdrawal, and inactivity charges.

How to pick a Low-Spread Forex Broker?

Before you start trading, research your shortlisted brokers. While some forex brokers promise low dealing spreads, they might not be the best for your trading strategy.

You should watch out for these situations:

- Be on the lookout for fixed spreads. This could mean that it is wider than average. The broker might also be trading against your positions as a market maker.

- Make sure the broker is regulated by a top-tier regulator. This adds an extra level of confidence in the ethical business practices of your broker.

- Make sure the minimum deposit isn't too high.

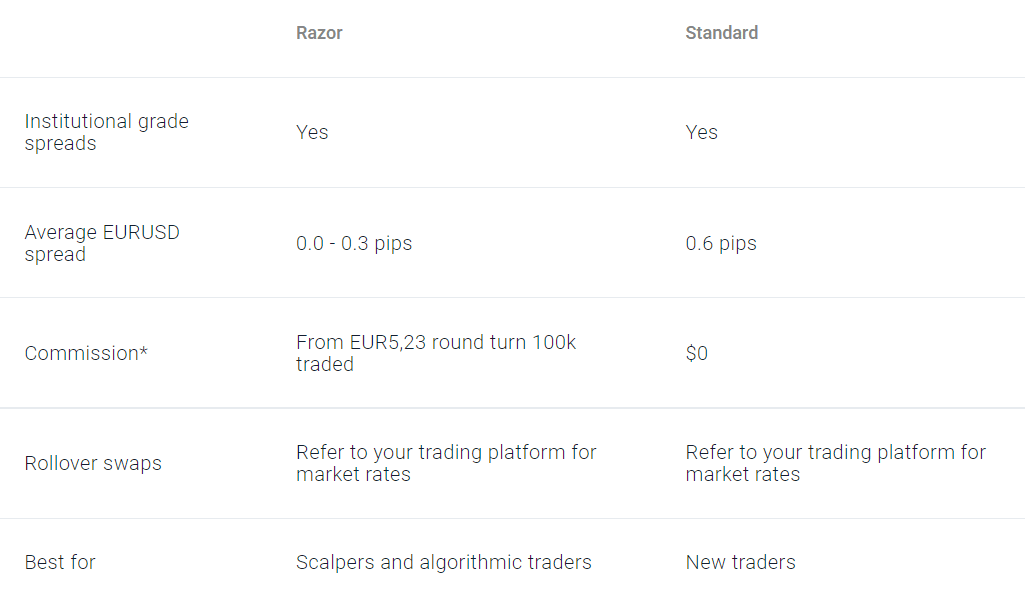

- Check the spreads on different currency pairs and account types. While some low s brokers advertise low costs, spreads can vary depending on currency pairs or account types.